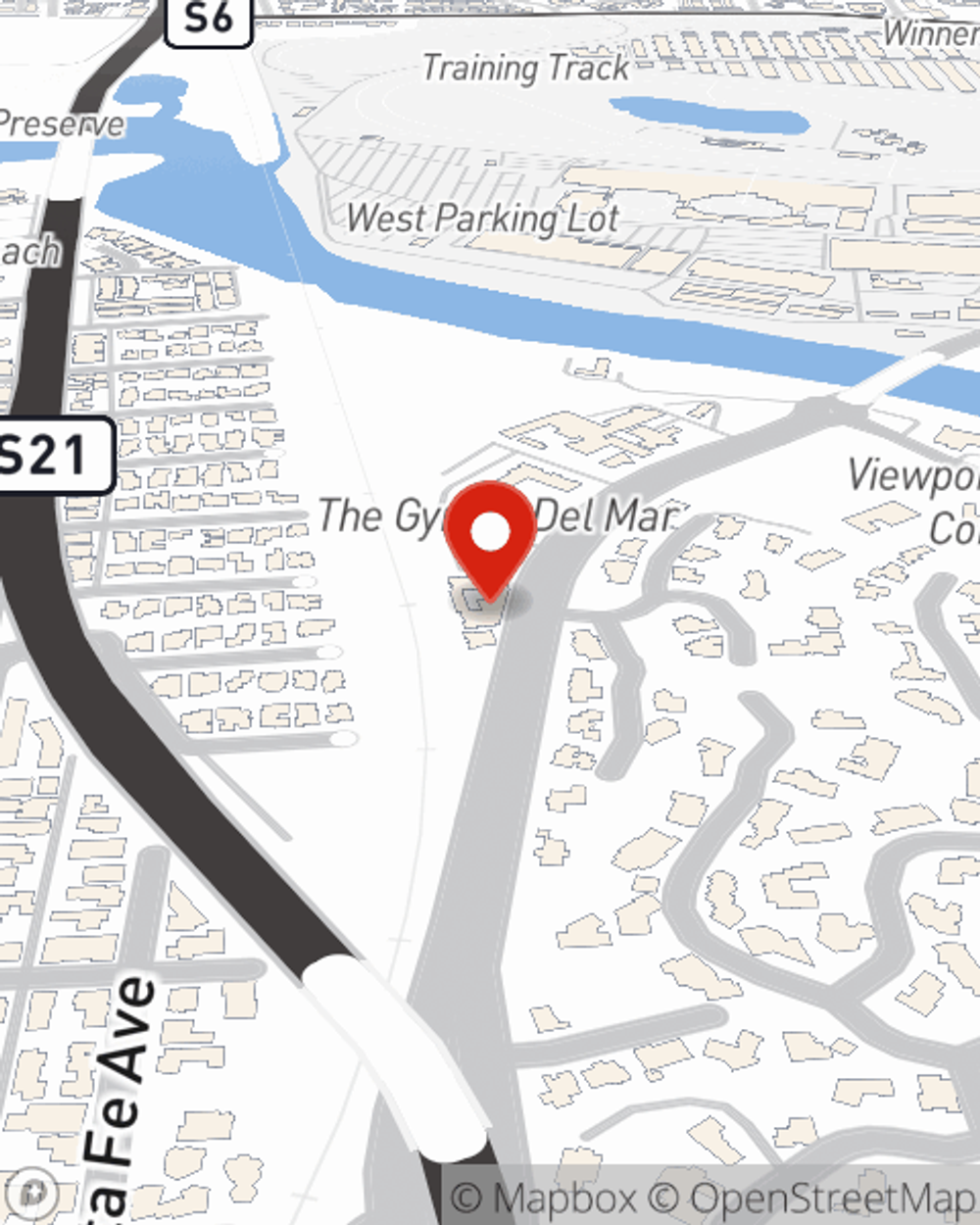

Life Insurance in and around Del Mar

Coverage for your loved ones' sake

Life happens. Don't wait.

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

One of the greatest ways you can protect your loved ones is by taking the steps to be prepared. As weary as thinking about this may make you feel, it's a good idea to make sure you have life insurance to prepare for the unexpected.

Coverage for your loved ones' sake

Life happens. Don't wait.

Life Insurance Options To Fit Your Needs

The beneficiary designated in your Life insurance policy can help cover certain expenses for the people you're closest to when you pass. The death benefit can help with things such as car payments, house payments or ongoing expenses. With State Farm, you can rely on us to be there when it's needed most, while also providing compassionate, dependable service.

If you're looking for dependable coverage and considerate service, you're in the right place. Contact State Farm agent Todd DeRenzis now to discover which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Todd at (858) 455-6881 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

Todd DeRenzis

State Farm® Insurance AgentSimple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.